|

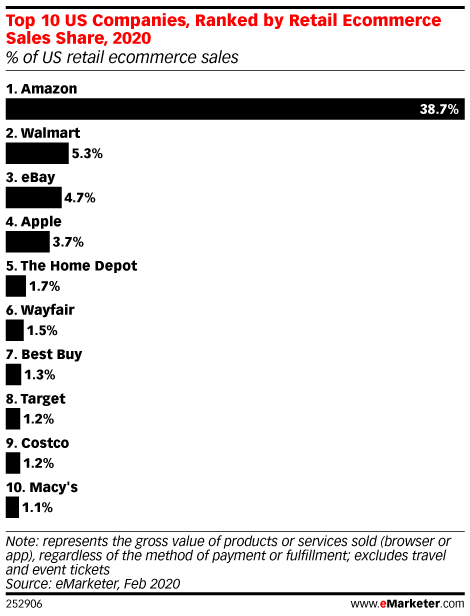

by Andrew Martineau I’ve always wondered why Shopping Malls didn’t market themselves like a Big-Box Retailer. Both are usually indoors, both occupy an enormous amount of physical space, and both offer a variety of products to its customers. We can certainly argue that the most significant difference is that a Big Box Retailer is mostly a single housed store that offers one-stop, purposeful shopping to clients at usually lower prices, and a shopping mall provides multi-store shopping at prices set by each retailer with many opportunities for gathering and leisure. I’m certainly simplifying things a bit, but humor me for a bit. The Big-Box Retailer - Target is poised to be a top e-commerce player in 2020, notwithstanding the effects of the coronavirus. They have become the 8th largest e-commerce player in the U.S, according to eMarketer’s latest market share rankings and have figured out a robust e-commerce strategy that gives its customers options to purchase either online or offline. Now, of course, store renovations, in-store pickup, drive-up and delivery with Shipt (recently acquired by Target) has something to do with their rise to the Top 10, but shopping malls can adopt all these strategies in a very similar way. If shopping malls were to up their e-commerce game, or have one, to begin with, their retailers could use their brick-and-mortar locations to fulfil additional online orders and the many mom-and-pop retailers that are in all B & C malls that don’t have a website, can benefit from the digital strategies of a powerful e-commerce platform at their respective mall locations. Not to mention, being able to analyze customer behavior by getting real-time updates of popular categories, searches and products that could influence tenant mix for leasing agents to prospect in the future. It is certainly understandable that revenues from e-commerce sales on a shopping malls website are going to be less profitable than a Big Box Retailer. Still, if they were to mimic the compensation structure of an Amazon seller which can range from $0 to $39.99 per month for Account fees, and 6% to 20% of the product’s selling price for Product fees, with the average seller paying 15%, it can be a tremendous boost to every mall’s bottom line and allow for continued sales in Pandemic situations, like the one we find ourselves in today.

Malls have always been a good reflection of American Culture as they provide a place for gathering and enjoying experiences. But, American Culture along with the rest of the world has undoubtedly gravitated to spending quite a bit of time online as opposed to a physical location, and malls never really invested a ton of time or money in joining them. We can certainly see what not investing much in a digital presence has done for many Big-Box retailers looking to catch up with Amazon and in a smaller sense what it has done to traditional retailers that are still working on perfecting their digital presence. And while many brick-and-mortar retailers play catch up, Amazon is getting into the brick-and-mortar game and able to leverage their dominance of online to leverage their learning curve for brick-and-mortar. So how do Shopping Mall owners adapt to a rapidly changing online world and leverage their real estate assets spread across the country to compete? Invest significantly in Digital Operations! Not just by building Digital Teams that figure out creative strategies and applications to enhance the offline/in-mall experience, but to Teams that can create a proficient and competitive online/e-commerce experience. They should even explore, cloud computing, digital streaming (more on this in another post) and artificial intelligence, much like the Big Four technology companies Amazon, Google, Apple and Facebook. Shopping Malls are certainly uniquely positioned to come out the winners in the retail environment of the future if consumers can shop seamlessly across online and offline channels of which shopping malls have in spades. Shopping center GM’s, Marketing Director’s and Asset Teams know the mall business inside and out, and most of them have been honing their skills in the industry for decades. Focusing on building teams that understand the online space is a crucial pivot for shopping mall owners wanting to survive, especially in the wake of COVID-19, significant drops in already declining traffic and continued retail bankruptcies. If shopping malls reconfigured their service courts to allow for retailers to operate as mini-fulfilment centers for a mall’s e-commerce platform as well as the retailer’s, there would be many benefits including savings on shipping, improved delivery speed and allowing retailers to fulfil orders even when their fulfilment center is out of stock. To accomplish this, malls could overhaul their Customer Service offering to include bringing online orders outside and loaded into cars and coordinating same-day delivery for customers within the primary trade area. It will not only create an additional revenue stream for the mall and its respective retailers but allow the mall Customer Service staff to form a personal bond with its customers. All in all, shopping malls are still the destination of choice to get the perfect mix of offline experiences in the form of movie theaters, restaurants, gyms, and retail stores all in one place. But the industry’s survival lies in changing customer behavior by providing seamless integration across a digital and physical shopping environment thereby creating omnichannel synergies, that will develop into a deeper loyalty with the customers, increased spend both with in-store and drive-up business (which will also increase in-mall traffic), and the mall’s overall NOI goals.

0 Comments

by Andrew Martineau As shopping centers, who have already been in the process of reinventing with a growing list of store closures, over-leveraged retailers, bankruptcies, delayed effects of the Great Recession, and increased online shopping try to survive. This pandemic comes out of nowhere and makes the once-popular Experience Economy, void of the very Experiences that made it a strategy for driving traffic and attracting and retaining customers.

Over the last couple of years, the industry had some great success with adding more entertainment options to their merchandise mix in the form of bowling alleys, restaurants, bars and other socially-oriented businesses. However, in a pandemic such as this, those businesses will find it hard to survive even when the malls reopen, and people start venturing out again. What will be the new addition to the tenant mix that would offer something to consumers that they can’t obtain online? I believe that the new category is Wellness. If there is one thing that the Coronavirus has taught all of us is that being healthy is more important now more than ever. The very nature of a hugely contagious virus affecting the innate mechanisms that make us social beings is a wake-up call for everyone, especially ones with largely manageable pre-existing health conditions like diabetes or being overweight. According to a report by Collier’s International titled The Fountain of Wellness in Retail: Transforming the Consumer Healthcare. The Wellness category in an ideal position to become the mini anchor to backfill vacancies and reinvent the merchandising program of many shopping destinations. This developing category may be the best antidote to an industry plagued by store closings, lost business and revenue, as people make the decision to do more of their shopping online and leave in-person experiences to those that are necessary or something that can add to their general Wellness. In a recent ICSC Research for which Engine Insight surveyed 1,004 U.S. Adults. Fifty-seven percent welcome shops whose products are mainly infused with CBD, such as oils and lotions for personal care and Wellness. Fifty-five percent welcome legal cannabis dispensaries for all types of use. Thirty-two percent of consumers surveyed would be more likely to visit a shopping center if its tenants include a CBD shop, and thirty-five percent would be more inclined to visit a shopping center with a legal dispensary. Read the full report from ICSC Research here. Being confined to your home for this long certainly has people itching for socialization, but where that socialization happens is going to be something that will happen organically or directed depending on what the options are. B and C malls (if they haven’t already done so) should double down on adding Urgent Care Clinics, Dental Offices, Grocery stores and other essential services to their tenant mix. The multi-category successes of entities like Walmart and Target during this pandemic are great examples of this - with health, food and cleaning supplies categories making up for losses in other areas - and what is a shopping center if not a multi-category shopping destination. In addition to yoga studios, gyms, psychologist offices, physiotherapists offices, massage businesses, wellness spas, supplement shops and CBD-product merchants, malls should look at adding more health-related tenants and activities to the mix. Food Courts with more healthy foods should be considered, along with adding mile marker floor decals for in-center walking and converting parking on the perimeter of centers to green space for rediscovering how much taking a walk in nature renews our spirits and nurtures our soul. It is a fact that many cities and urban areas across the country suffer from a lack of green space, and if a visit to the local mall can provide that. It would certainly be something to invest some time and energy into - think grabbing a meal from the food court and eating it outside with nature, or doing some exercise in the morning and grabbing a smoothie or doing some shopping in the mall afterwards - the possibilities are endless, and the future is Wellness. By Andrew Martineau For an industry in a state of flux and shopping center developers and management companies putting more emphasis on the creation of experiences to counter the many sales lost to e-commerce, the Coronavirus is an unexpected and somewhat devastating new development to throw into the mix. Not only are fledgeling B and C malls struggling as it is, but the pandemic has also forced shopping centers to close doors until further notice. This development will force any mom-and-pop retailers who never developed an e-commerce business, with no means of revenue and the big box stores teetering on bankruptcy to look at this as the straw that broke the camel’s back. Furthermore, when will shoppers trust that it is ok to gather in groups of more than ten people and will they have any money - with the many people losing their jobs to do any shopping at all? With all the uncertainty in the air, many brands have stopped paying rent and haven’t ordered new product - and even if they wanted to order products, most factories in China have been closed down during China’s fight to stop the spread of the virus. It is no secret, that China manufactures a large amount of product for the world’s brands and independent retailers, and this shut down. However, temporary has caused some significant breakdowns in the supply chain with products not being manufactured and spotty travel, causing delays in shipments. When you think that the US accounts for more than 80% of toy imports from China, profitable brands like Hasbro and Mattel will see considerable losses, the longer the pandemic remains uncurable. Many global Original Equipment Manufacturers (OEM) have been quickly shifting orders to secondary or tertiary suppliers to make up the missed delivery from their primary suppliers and moving some core business priorities back to their factories. Some have looked into retooling their production systems to make completely different products. Automobile manufacturer Shanghai-GM-Wuling (SGMW) who quickly retooled its production system to produce medical face masks has generated rewarding revenues and positive reputation for the company. In China, some companies have charted buses and even airplanes to bring back workforce from remote regions to help with the backlog of orders halted as China works on mitigating the spread of the virus. Others have started to adopt automation to make up for labour shortages, and others are employing technology to train new employees quickly as there is a dire need for more hourly workers. Global supply chains are also looking into designing their supply chain models to include KPI’s for resilience, responsiveness, and reconfigurability. If China is rebuilding its global supply chain to be more resilient, flexible, and automated, so should the US. It is undoubtedly an excellent time to build a competitive, flexible and automated manufacturing industry here in the US to help shield from the possibilities of a pandemic like this shutting down the US economy in the future. All is not lost for every brick-and-mortar retailer though. Companies like Walmart and Target who buy products in mass quantities will see supply chain disruption like other retailers, but find increased revenue in the areas of grocery and disease-fighting essentials that consumers have been buying in mass quantities. This multi-category portfolio and evolved omnichannel operation should help balance the losses in other regions and prove valuable for them in their financial expectations for 2020. The lesson here is having a multi-category portfolio, and an evolved omnichannel operation is key to survival for anyone that has a brick-and-mortar location or has hopes of opening one. I have always been a believer that the luxury market is recession-proof, and the move by many shopping center developers to focus on the 1%, and adding more luxury retail to their flagship stores is a no brainer in a once-booming economy. With luxury spending by Chinese customers accounting for 33% of the global market, a slowdown in consumer purchasing in China, in addition to the cancelling of many of the world’s popular fashion weeks, the devastating effects on the global economy and the usually recession-proof luxury market is incredible. Not to mention the fact that luxury brands have had a history of strong sales in their brick-and-mortar locations as customers interested in purchasing a $20k Louis Vuitton bag don’t usually make that purchase online. Times like this is when innovative technologies tend to emerge. Still, the only thing I’ve seen is online small business lender Kabbage launching a platform that allows consumers to buy gift certificates to support local small businesses during the coronavirus crisis. Certificates purchased through Kabbage’s platform can be redeemed by consumers at any time. After each gift certificate purchase, Kabbage will hold up to 10% of the settlement funds in reserve until the gift certificate is redeemed. The only caveat is, if the small business does not survive, the gift certificate cannot be redeemed or refunded. And last but not least is the popularity and growth of delivery services, with many people forced to stay-at-home and trying their best to avoid going out for anything. This trend is certainly not going to disappear anytime soon as getting people to go back to brick-and-mortar stores is going to be an ambitious proposition, especially for non-essential items. I know I’ve been spending more time purchasing items on Amazon in the last couple of months than I have in my entire life. Ten years ago, the term pop-up shop was another word for trunk show, but now it seems like the solution or strategy for many new and old retailers. As brick-and-mortar continues to lose traffic to online many brands, even online retailers, and celebrities alike have turned to pop-up shops in locations as varied as shopping centers, trendy neighborhoods and popular shopping districts to provide a showroom, showcase the latest products, test merchandise and downsize store locations.

Retailers online presence focuses on the algorithms and data gathering that influence a purchase, while a brick-and-mortar presence enables them to engage with their customers face-to-face and allow the consumer to touch and feel the merchandise. The pop-up concept is certainly attractive as it can be at a location for a short-term, cost less to rent, manage and build and test a market before a brand opens a full-fledged store and signs a long-term lease. Enclosed malls have been doing pop-up stores to some extent for quite some time and the concept is certainly more prevalent now that many centers are suffering from vacancies from anchor and long-time mall staples. But what does all of this mean for traditional retail. Well, for one it creates an incredible opportunity for specialty leasing agents to bring in some steady revenue although in multiple short-term stints. Two it creates a great opportunity for online brands to get their feet wet in the traditional retail world and finally it adds to the overall journey of discovery every consumer yearns for in this Experience Economy. Even brands like JCPenney utilized the pop-up store or store-within-store concept to revolutionize the store layout and make it easier for customers to find the brands they liked and for brands to have their own space to create a unique experience. In my opinion, it was a huge turning point for the brand - if it weren't for them dropping their signature coupons and discounting program for the length of time they did ... they would have been in a much better place than they are now. One opportunity that seems to be still left untapped within the pop-up space is for anchor stores like Macy's and JCPenney to utilize a part of their parking lots to create their own outdoor experience center where they lease their space to brands either wanting to come into their stores or ones that are already there. Yes, it will eat-up some valuable parking space, but if that space is generating income and providing an experience I think it’s certainly worth testing. Not to mention the fact that we have transportation options like Uber and Lyft for cities that don't have the most efficient public transportation, but for the ones that do - how much non-revenue generating space do you need anyway? With the continued emergence of the experience economy and the growth of e-commerce, mobile and even AR/VR/MR as a viable secondary retail channel, it is clear that the pop-up phenomenon is not going anywhere anytime soon. Toys “R” Us once the warehouse of toys and the retailer of choice for many Americans boys and girls is now finding it hard to adjust to a digital native child and parent.

But in my opinion, all is not lost for this once popular retailer that once was the go-to for parents looking to put a smile on their kids face. At the end of the day, this shopping center for toys fell into the same trap most shopping centers fell into - lack of a unique experience, mediocre customer service and competition from the shopping center killer Amazon. Just like any of today’s successful retailers, creating an experience in the stores and focusing on customer experience will increase sales and traffic to this once iconic toy store. But what do we do about Amazon? Focus on what Amazon can’t do - provide that in-person human interaction with stellar customer service, create avenues for kids to play with toys that they must bring home to continue the fun, and create opportunities for experience and discovery that tie into an online experience. And we did mention that this new customer is in a large part digital native so leveraging the many avenues to engage with these customers is paramount to a successful retailer in this new experience economy. The many types of technology that are available today make it easy to engage with consumers, collect data and gain strategic insights that will help further engage with the consumer and convert each visit into a purchase and each customer interaction to a return visit. Keep in mind we visit Yoni’s Coffee shop every day because Yoni knows what kind of coffee I like and what my kids are doing in school – it’s a plus if Yoni has a selection of the best coffee in the world. Understanding the customer with the use of data collected throughout the customer journey is essential to running a successful retail business but in the case of Toys “R” Us it also provides an opportunity to brands interested in finding out what their ideal consumer is interested in. The Walt Disney Company for instance, has started doing kid-centric focus groups where they meet with small groups of preschoolers and kindergartners to get their opinion on episodes in development for a series. This same model could prove to be a new revenue generator for a retailer like Toys “R” Us with a built-in audience of kids. Now what about the many opportunities technologies like AI offers today’s modern-day retailer? An AI enabled Geoffrey the Giraffe in stores greeting guests or an online customer service chatbot named Geoffrey who can answer all the questions you have about a certain product? What Amazon has managed to do in its rise to retail domination is; Accept occasional failure as the price of innovating, Work every day like it’s your first day in business and Give customers what they want before they know they want it ... pretty simple operating principles that can be applied to the Toys “R” Us business. |

AboutDisruption Retail is the official Thought Leadership platform for UniteUs Retail. Archives

May 2020

Categories |

|

Privacy Policy

Terms of Use Take down policy |

HoursM-F: 10am - 6pm

|

Telephone954-850-8581

|

© 2020 Disruption Retail - part of UniteUs Agency, a UniteUs Group Company. All rights reserved.

RSS Feed

RSS Feed